Source : HOMA CAPITAL

MTD: Month To Date.

3Y*, 5Y* : annualized returns, in calendar year.

ITD: Inception to Date.

Source : HOMA CAPITAL

MTD: Month To Date.

3Y*, 5Y* : annualized returns, in calendar year.

ITD: Inception to Date.

Source : HOMA CAPITAL

MTD: Month To Date.

3Y*, 5Y* : annualized returns, in calendar year.

ITD: Inception to Date.

- Class B EUR

-

Source : HOMA CAPITAL

MTD: Month To Date.

3Y*, 5Y* : annualized returns, in calendar year.

ITD: Inception to Date. - Class C EUR

-

Source : HOMA CAPITAL

MTD: Month To Date.

3Y*, 5Y* : annualized returns, in calendar year.

ITD: Inception to Date. - Class B USD

-

Source : HOMA CAPITAL

MTD: Month To Date.

3Y*, 5Y* : annualized returns, in calendar year.

ITD: Inception to Date.

In a nutshell

YCAP Tactical Investment seeks to generate a regular performance over a recommended time horizon of three years, while providing daily availability of the invested savings.

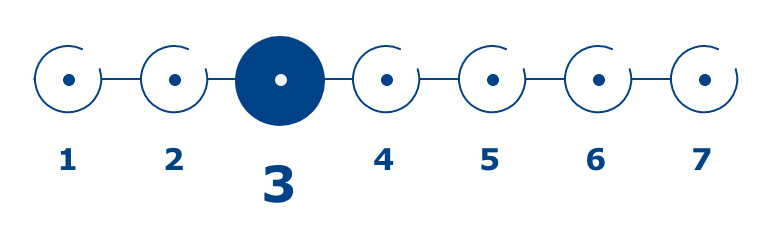

Risk level

Higher risk is associated with greater probability of higher return and lower risk with a greater probability of smaller return. You may not recover the amount originally invested. Before taking any investement decision, please carefully read the prospectus available below.

Management team

CFA

ANALYST / PORTFOLIO MANAGER

CFA

ANALYST / PORTFOLIO MANAGER

Performance

Evolution of the net asset value since inception

Past performance does not guarantee future performance.

Past performance does not guarantee future performance.

Past performance does not guarantee future performance.

- Class B EUR

-

Past performance does not guarantee future performance.

- Class C EUR

-

Past performance does not guarantee future performance.

- Class B USD

-

Past performance does not guarantee future performance.

Characteristics

LEGAL FORM

Sub-Fund (“SICAV”) governed by Luxembourg law (UCITS V)

CURRENCY

Euro

INCEPTION DATE

October 14th, 2014

ASSET CLASS

Equities, Bonds, credit and currency

ELIGIBILITY

All subscribers

ISIN CODE

LU0807707749

RECOMMENDED INVESTMENT PERIOD

At least 3 years

DISTRIBUTION POLICY

Capitalization

NAV CALCULATION

Daily

ORDER RECEPTION DEADLINE

12:00pm CET, on each applicable Subscription Valuation Day

CUSTODIAN

BNP Paribas Securities Services, Luxembourg Branch

FUND VALUATION

BNP Paribas Securities Services, Luxembourg Branch

AUDITOR

PricewaterhouseCoopers

LEGAL FORM

Sub-Fund (“SICAV”) governed by Luxembourg law (UCITS V)

CURRENCY

Euro

INCEPTION DATE

July 29th, 2024

ASSET CLASS

Equities, Bonds, credit and currency

ELIGIBILITY

All subscribers

ISIN CODE

LU2053090044

RECOMMENDED INVESTMENT PERIOD

At least 3 years

DISTRIBUTION POLICY

Capitalization

NAV CALCULATION

Daily

ORDER RECEPTION DEADLINE

12:00pm CET, on each applicable Subscription Valuation Day

CUSTODIAN

BNP Paribas Securities Services, Luxembourg Branch

FUND VALUATION

BNP Paribas Securities Services, Luxembourg Branch

AUDITOR

PricewaterhouseCoopers

LEGAL FORM

Sub-Fund (“SICAV”) governed by Luxembourg law (UCITS V)

CURRENCY

USD

INCEPTION DATE

March 22nd, 2013

ASSET CLASS

Equities, Bonds, credit and currency

ELIGIBILITY

All subscribers

ISIN CODE

LU0807708390

RECOMMENDED INVESTMENT PERIOD

At least 3 years

DISTRIBUTION POLICY

Capitalization

NAV CALCULATION

Daily

ORDER RECEPTION DEADLINE

12:00pm CET, on each applicable Subscription Valuation Day

CUSTODIAN

BNP Paribas Securities Services, Luxembourg Branch

FUND VALUATION

BNP Paribas Securities Services, Luxembourg Branch

AUDITOR

PricewaterhouseCoopers

- Class B EUR

-

LEGAL FORM

Sub-Fund (“SICAV”) governed by Luxembourg law (UCITS V)

CURRENCY

Euro

INCEPTION DATE

October 14th, 2014

ASSET CLASS

Equities, Bonds, credit and currency

ELIGIBILITY

All subscribers

ISIN CODE

LU0807707749

RECOMMENDED INVESTMENT PERIOD

At least 3 years

DISTRIBUTION POLICY

Capitalization

NAV CALCULATION

Daily

ORDER RECEPTION DEADLINE

12:00pm CET, on each applicable Subscription Valuation Day

CUSTODIAN

BNP Paribas Securities Services, Luxembourg Branch

FUND VALUATION

BNP Paribas Securities Services, Luxembourg Branch

AUDITOR

PricewaterhouseCoopers

- Class C EUR

-

LEGAL FORM

Sub-Fund (“SICAV”) governed by Luxembourg law (UCITS V)

CURRENCY

Euro

INCEPTION DATE

July 29th, 2024

ASSET CLASS

Equities, Bonds, credit and currency

ELIGIBILITY

All subscribers

ISIN CODE

LU2053090044

RECOMMENDED INVESTMENT PERIOD

At least 3 years

DISTRIBUTION POLICY

Capitalization

NAV CALCULATION

Daily

ORDER RECEPTION DEADLINE

12:00pm CET, on each applicable Subscription Valuation Day

CUSTODIAN

BNP Paribas Securities Services, Luxembourg Branch

FUND VALUATION

BNP Paribas Securities Services, Luxembourg Branch

AUDITOR

PricewaterhouseCoopers

- Class B USD

-

LEGAL FORM

Sub-Fund (“SICAV”) governed by Luxembourg law (UCITS V)

CURRENCY

USD

INCEPTION DATE

March 22nd, 2013

ASSET CLASS

Equities, Bonds, credit and currency

ELIGIBILITY

All subscribers

ISIN CODE

LU0807708390

RECOMMENDED INVESTMENT PERIOD

At least 3 years

DISTRIBUTION POLICY

Capitalization

NAV CALCULATION

Daily

ORDER RECEPTION DEADLINE

12:00pm CET, on each applicable Subscription Valuation Day

CUSTODIAN

BNP Paribas Securities Services, Luxembourg Branch

FUND VALUATION

BNP Paribas Securities Services, Luxembourg Branch

AUDITOR

PricewaterhouseCoopers

Management fees

MANAGEMENT FEE

1.80% maximum

PERFORMANCE FEE

N/A

SUBSCRIPTION AND REDEMPTION FEES

0.50%

ONGOING CHARGES

3.11% (incl. Management fees)

MANAGEMENT FEE

2.0% maximum

PERFORMANCE FEE

N/A

SUBSCRIPTION AND REDEMPTION FEES

0.50%

ONGOING CHARGES

3.11% (incl. Management fees)

MANAGEMENT FEE

1.80% maximum

PERFORMANCE FEE

N/A

SUBSCRIPTION AND REDEMPTION FEES

0.50%

ONGOING CHARGES

3.11% (incl. Management fees)

- Class B EUR

-

MANAGEMENT FEE

1.80% maximum

PERFORMANCE FEE

N/A

SUBSCRIPTION AND REDEMPTION FEES

0.50%

ONGOING CHARGES

3.11% (incl. Management fees)

- Class C EUR

-

MANAGEMENT FEE

2.0% maximum

PERFORMANCE FEE

N/A

SUBSCRIPTION AND REDEMPTION FEES

0.50%

ONGOING CHARGES

3.11% (incl. Management fees)

- Class B USD

-

MANAGEMENT FEE

1.80% maximum

PERFORMANCE FEE

N/A

SUBSCRIPTION AND REDEMPTION FEES

0.50%

ONGOING CHARGES

3.11% (incl. Management fees)

Legal documents

Marketing documents

Reporting January 2026 (Class B EUR)

Reporting January 2026 (Class C EUR)

Reporting January 2026 (Class B USD)

- Class B EUR

-

Reporting January 2026 (Class B EUR)

- Class C EUR

-

Reporting January 2026 (Class C EUR)

- Class B USD

-

Reporting January 2026 (Class B USD)