Source : HOMA CAPITAL

MTD: Month To Date.

3Y*, 5Y* : annualized returns, in calendar year.

ITD: Inception to Date.

Source : HOMA CAPITAL

MTD: Month To Date.

3Y*, 5Y* : annualized returns, in calendar year.

ITD: Inception to Date.

In a nutshell

This strategy aims to improve the social factor of the companies in which the fund is a shareholder through a long-term commitment and a Social Impact Committee composed of personalities acknowledged in the management of the Quality of Life at Work.

HOMA Social Impact France invests in about twenty stocks with a market capitalization up to 2.5 billion euros. The selection is made through a fundamental stock picking process combined with a Best in Class and Best Effort ESG approach. The resulting portfolio takes a positive approach to enhancing the value of both the human capital and the companies it holds.

Particular attention is paid to the extra-financial management of the companies in the portfolio by setting up a Social Impact Committee. This committee is made up of well-known experts in the field of QWL (Quality of Life at Work) whose role is to validate the awareness plan for each entity, to monitor it and to alert the investment committee if the potential for progress in a company’s human capital seems limited.

The members of the Committee are Jean-Claude Mailly (Equality and Social Dialogue), Dr. Jean-Martin Cohen-Solal (Health and Work Organization) and Karine Melloul (Management and Career Development), ESG experts at HOMA CAPITAL.

- The fund is classified under Article 9 of the SFDR and held the “Label Relance” until October 2025.

Disclaimer :

– Total subscriptions are limited to 100 million euros.

– Subscription orders for units of the FCP will no longer be accepted after the centralization of 31/03/2023**.

– Holders’ assets are blocked for a minimum period of 5 years. No redemption request will be accepted before April 2, 2028.

** In any case, total subscriptions may not exceed 100 million euros.

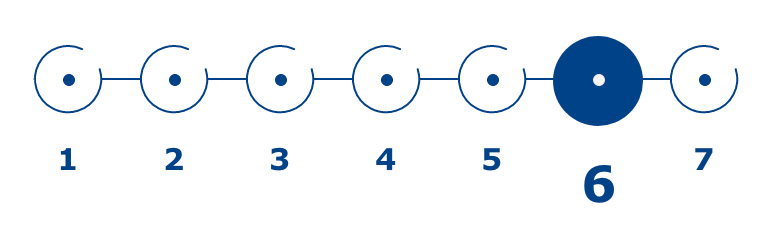

Risk level

Higher risk is associated with greater probability of higher return and lower risk with a greater probability of smaller return. You may not recover the amount originally invested. Before taking any investement decision, please carefully read the prospectus available below.

Management team

ANALYST / PORTFOLIO MANAGER

CFA

ANALYST / PORTFOLIO MANAGER

Performance

Evolution of the net asset value since inception

Past performance does not guarantee future performance.

Past performance does not guarantee future performance.

Characteristics

LEGAL FORM

Alternative Investment Fund (AIF) under French law constituted as a FPS (Specialized Professional Fund)

CURRENCY

Euro

INCEPTION DATE

2021

ASSET CLASS

Equities

ELIGIBILITY

Institutional Investors

ISIN CODE

FR00140059Y7

RECOMMENDED INVESTMENT PERIOD

At least 5 years

DISTRIBUTION POLICY

Capitalization

NAV CALCULATION

Daily

ORDER RECEPTION DEADLINE

Before 4:00pm CET, 1 business day before the relevant NAV date

CUSTODIAN

Société Générale S.A.

FUND VALUATION

Société Générale S.A.

AUDITOR

PricewaterhouseCoopers

LEGAL FORM

Alternative Investment Fund (AIF) under French law constituted as a FPS (Specialized Professional Fund)

CURRENCY

Euro

INCEPTION DATE

2021

ASSET CLASS

Equities

ELIGIBILITY

Institutional Investors

ISIN CODE

FR00140059Z4

RECOMMENDED INVESTMENT PERIOD

At least 5 years

DISTRIBUTION POLICY

Capitalization

NAV CALCULATION

Daily

ORDER RECEPTION DEADLINE

Before 4:00pm CET, 1 business day before the relevant NAV date

CUSTODIAN

Société Générale S.A.

FUND VALUATION

Société Générale S.A.

AUDITOR

PricewaterhouseCoopers

- Class SI EUR

-

LEGAL FORM

Alternative Investment Fund (AIF) under French law constituted as a FPS (Specialized Professional Fund)

CURRENCY

Euro

INCEPTION DATE

2021

ASSET CLASS

Equities

ELIGIBILITY

Institutional Investors

ISIN CODE

FR00140059Y7

RECOMMENDED INVESTMENT PERIOD

At least 5 years

DISTRIBUTION POLICY

Capitalization

NAV CALCULATION

Daily

ORDER RECEPTION DEADLINE

Before 4:00pm CET, 1 business day before the relevant NAV date

CUSTODIAN

Société Générale S.A.

FUND VALUATION

Société Générale S.A.

AUDITOR

PricewaterhouseCoopers

- Class I EUR

-

LEGAL FORM

Alternative Investment Fund (AIF) under French law constituted as a FPS (Specialized Professional Fund)

CURRENCY

Euro

INCEPTION DATE

2021

ASSET CLASS

Equities

ELIGIBILITY

Institutional Investors

ISIN CODE

FR00140059Z4

RECOMMENDED INVESTMENT PERIOD

At least 5 years

DISTRIBUTION POLICY

Capitalization

NAV CALCULATION

Daily

ORDER RECEPTION DEADLINE

Before 4:00pm CET, 1 business day before the relevant NAV date

CUSTODIAN

Société Générale S.A.

FUND VALUATION

Société Générale S.A.

AUDITOR

PricewaterhouseCoopers

Management fees

MANAGEMENT FEE

0.90% maximum

ADDITIONAL EXTERNAL FEE

0.10%

SUBSCRIPTION AND REDEMPTION FEES

N/A

MANAGEMENT FEE

1.20% maximum

ADDITIONAL EXTERNAL FEE

0.10%

SUBSCRIPTION AND REDEMPTION FEES

N/A

Legal documents

(French version only)

SFDR Pre-contractual disclosure

(French version only)

Annual report (2024) – French version only

Periodic disclosure 2024 – French version only

Marketing documents

Reporting January 2026 (French version only)

Reporting January 2026 (French version only)

- Class SI

-

Reporting January 2026 (French version only)

- Class I

-

Reporting January 2026 (French version only)