Source : HOMA CAPITAL

MTD: Month To Date.

3Y*, 5Y* : annualized returns, in calendar year.

ITD: Inception to Date.

The fund share class A USD is not active since September 17 2021.

Source : HOMA CAPITAL

MTD: Month To Date.

3Y*, 5Y* : annualized returns, in calendar year.

ITD: Inception to Date.

- Class A EUR

-

Source : HOMA CAPITAL

MTD: Month To Date.

3Y*, 5Y* : annualized returns, in calendar year.

ITD: Inception to Date. - Class A USD

-

The fund share class A USD is not active since September 17 2021.

Source : HOMA CAPITAL

MTD: Month To Date.

3Y*, 5Y* : annualized returns, in calendar year.

ITD: Inception to Date.

In a nutshell

YCAP Tactical Investment seeks to generate a regular performance over a recommended time horizon of three years, while providing daily availability of the invested savings.

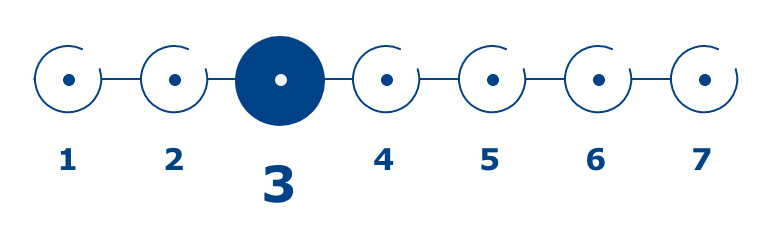

Risk level

Higher risk is associated with greater probability of higher return and lower risk with a greater probability of smaller return. You may not recover the amount originally invested. Before taking any investement decision, please carefully read the prospectus available below.

Management team

CFA

ANALYST / PORTFOLIO MANAGER

CFA

ANALYST / PORTFOLIO MANAGER

Performance

Evolution of the net asset value since inception

Past performance does not guarantee future performance.

The fund share class A USD is not active since September 17 2021.

Past performance does not guarantee future performance.

- Class A EUR

-

Past performance does not guarantee future performance.

- Class A USD

-

The fund share class A USD is not active since September 17 2021.

Past performance does not guarantee future performance.

Characteristics

LEGAL FORM

Sub-Fund (“SICAV”) governed by Luxembourg law (UCITS V)

CURRENCY

Euro

INCEPTION DATE

October 1st, 2018

ASSET CLASS

Equities, Bonds, credit and currency

ELIGIBILITY

Institutional Investors

ISIN CODE

LU0807706857

RECOMMENDED INVESTMENT PERIOD

At least 3 years

DISTRIBUTION POLICY

Capitalization

NAV CALCULATION

Daily

ORDER RECEPTION DEADLINE

12:00pm CET, on each applicable Subscription Valuation Day

CUSTODIAN

BNP Paribas Securities Services, Luxembourg Branch

FUND VALUATION

BNP Paribas Securities Services, Luxembourg Branch

AUDITOR

PricewaterhouseCoopers

LEGAL FORM

Sub-Fund (“SICAV”) governed by Luxembourg law (UCITS V)

CURRENCY

USD

INCEPTION DATE

October 1st, 2018

ASSET CLASS

Equities, Bonds, credit and currency

ELIGIBILITY

Institutional Investors

ISIN CODE

LU0807707582

RECOMMENDED INVESTMENT PERIOD

At least 3 years

DISTRIBUTION POLICY

Capitalization

NAV CALCULATION

Daily

ORDER RECEPTION DEADLINE

12:00pm CET, on each applicable Subscription Valuation Day

CUSTODIAN

BNP Paribas Securities Services, Luxembourg Branch

FUND VALUATION

BNP Paribas Securities Services, Luxembourg Branch

AUDITOR

PricewaterhouseCoopers

- Class A EUR

-

LEGAL FORM

Sub-Fund (“SICAV”) governed by Luxembourg law (UCITS V)

CURRENCY

Euro

INCEPTION DATE

October 1st, 2018

ASSET CLASS

Equities, Bonds, credit and currency

ELIGIBILITY

Institutional Investors

ISIN CODE

LU0807706857

RECOMMENDED INVESTMENT PERIOD

At least 3 years

DISTRIBUTION POLICY

Capitalization

NAV CALCULATION

Daily

ORDER RECEPTION DEADLINE

12:00pm CET, on each applicable Subscription Valuation Day

CUSTODIAN

BNP Paribas Securities Services, Luxembourg Branch

FUND VALUATION

BNP Paribas Securities Services, Luxembourg Branch

AUDITOR

PricewaterhouseCoopers

- Class A USD

-

LEGAL FORM

Sub-Fund (“SICAV”) governed by Luxembourg law (UCITS V)

CURRENCY

USD

INCEPTION DATE

October 1st, 2018

ASSET CLASS

Equities, Bonds, credit and currency

ELIGIBILITY

Institutional Investors

ISIN CODE

LU0807707582

RECOMMENDED INVESTMENT PERIOD

At least 3 years

DISTRIBUTION POLICY

Capitalization

NAV CALCULATION

Daily

ORDER RECEPTION DEADLINE

12:00pm CET, on each applicable Subscription Valuation Day

CUSTODIAN

BNP Paribas Securities Services, Luxembourg Branch

FUND VALUATION

BNP Paribas Securities Services, Luxembourg Branch

AUDITOR

PricewaterhouseCoopers

Management fees

MANAGEMENT FEE

0.9% maximum

PERFORMANCE FEE

N/A

SUBSCRIPTION AND REDEMPTION FEES

0.5% maximum

ONGOING CHARGES

2.16 % (incl. Management fees)

MANAGEMENT FEE

0.90% MAX

PERFORMANCE FEE

N/A

SUBSCRIPTION AND REDEMPTION FEES

0.50%

ONGOING CHARGES

N/A

- Class A EUR

-

MANAGEMENT FEE

0.9% maximum

PERFORMANCE FEE

N/A

SUBSCRIPTION AND REDEMPTION FEES

0.5% maximum

ONGOING CHARGES

2.16 % (incl. Management fees)

- Class A USD

-

MANAGEMENT FEE

0.90% MAX

PERFORMANCE FEE

N/A

SUBSCRIPTION AND REDEMPTION FEES

0.50%

ONGOING CHARGES

N/A

Legal documents

Marketing documents

Reporting January 2026 (Class A EUR)

Previous monthly reports are available upon request via email contact@homacapital.fr

Reporting August 2021 (Class A USD)

Previous monthly reports are available upon request via email contact@homacapital.fr

- Class A EUR

-

Reporting January 2026 (Class A EUR)

Previous monthly reports are available upon request via email contact@homacapital.fr

- Class A USD

-

Reporting August 2021 (Class A USD)

Previous monthly reports are available upon request via email contact@homacapital.fr