Our solutions

Our funds

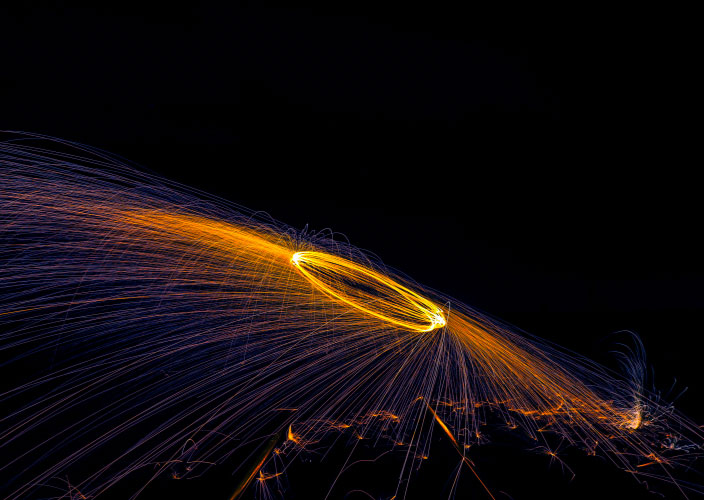

We aim to strike a balance between capital appreciation and resilience by exploiting allocations as the main performance driver.

What makes us stand out is our focus on proprietary allocation models that incorporate continuous trading signals across 500+ markets globally.