Source : HOMA CAPITAL

MTD: Month To Date.

3Y*, 5Y* : annualized returns, in calendar year.

ITD: Inception to Date.

In a nutshell

This fund seeks to reconcile financial and social performance by selecting mainly “Green” bonds with a favorable environmental impact in France, issued by public or private issuers and falls under Article 9 of the SFDR regulations.*

The investment policy limits the investment universe to a minimum of 75% of assets to certain Green Bonds that comply with the Green Bonds Principles (GBP).

In addition to the main strategy, the fund may invest up to 25% in sustainability linked bonds issued by an entity headquartered in France, social bonds and sustainability bonds. The sensitivity range of the fund will be between 0 and 10.

Within this investment universe, the management team applies a double filter:

- A rigorous selection of issuers based on their credit risk, with a preference for the highest rated issuers (Investment Grade).

A selection of projects whose societal and social impacts are assessed by a committee including Jean-Claude Mailly, Dr. Jean-Martin Cohen-Solal and Karine Melloul, board members of HOMA Capital.

The issues financed by the fund meet 13 of the 17 Sustainable Development Goals (SDGs) set up by the United Nations and include projects in various fields: real estate (in particular HQE renovation and energy improvement); transport infrastructure, the fight against the digital and social divide; senior citizen residences, EHPAD and nursing homes.

* The SFDR Article 9 designates products with a sustainable investment objective, i.e., that invest in an economic activity that contributes to an environmental and/or social objective.

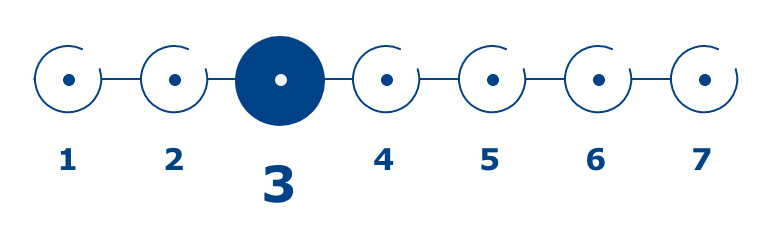

Risk level

Higher risk is associated with greater probability of higher return and lower risk with a greater probability of smaller return. You may not recover the amount originally invested. Before taking any investement decision, please carefully read the prospectus available below.

Management team

CFA

ANALYST / PORTFOLIO MANAGER

CFA

ANALYST / PORTFOLIO MANAGER

Performance

Evolution of the net asset value since inception

Past performance does not guarantee future performance.

Characteristics

LEGAL FORM

French mutual fund (FCP) incorporated in France

CURRENCY

Euro

INCEPTION DATE

April 23rd, 2019

ASSET CLASS

Corporate and Government bonds

ELIGIBILITY

All subscribers, with a focus on Institutional Investors

ISIN CODE

FR0013387107

RECOMMENDED INVESTMENT PERIOD

At least 3 years

DISTRIBUTION POLICY

Capitalization

NAV CALCULATION

Daily

ORDER RECEPTION DEADLINE

4:00 pm, 1 business day before the relevant NAV date

CUSTODIAN

Société Générale S.A.

FUND VALUATION

Société Générale S.A.

AUDITOR

PricewaterhouseCoopers

Management fees

MANAGEMENT FEE

Maximum 0.40%

PERFORMANCE FEE

N/A

SUBSCRIPTION FEE

N/A

ONGOING CHARGES

0.32%

Legal documents

Marketing documents

Reporting March 2024 (French version available only)

Previous monthly reports are available upon request via email contact@homacapital.fr